Shenzhen Energy Source Electronics: A Key Player in China’s Component Market

China’s electronic component market is evolving rapidly, shaped by global demand for semiconductors, the AI boom, and industrial upgrading. Among the rising forces, Shenzhen Energy Source Electronics has emerged as an important distributor, carving out its position in a competitive landscape dominated by billion-yuan players. As the 2024 “Top 25 Chinese Component Distributors by Revenue” report shows, the sector has reached record highs, with firms like Energy Source standing at the center of transformation. This article explores the company’s background, performance, and its role within the broader component distribution market, offering insights into how it is leveraging AI-driven opportunities, global expansion, and China’s push toward semiconductor self-reliance.

Background of Shenzhen Energy Source Electronics

Shenzhen Energy Source Electronics, headquartered in China’s technology hub Shenzhen, has gradually built a strong presence in the domestic component distribution industry. While not yet among the “Big Three” (SAC, TechSource, Shannong), its consistent revenue growth reflects resilience in a market undergoing consolidation.

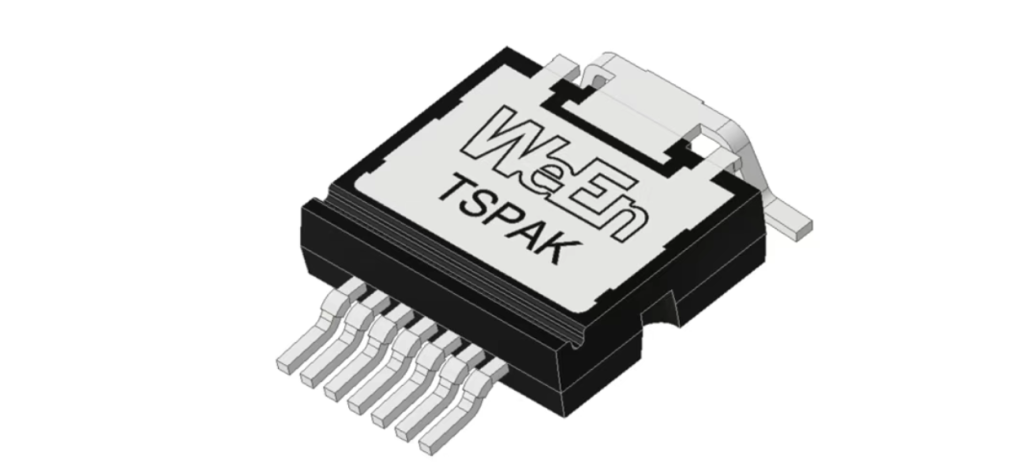

Founded with a focus on semiconductors, passive components, and embedded solutions, the company has become a trusted partner for Chinese manufacturers in consumer electronics, automotive, and industrial automation. Its operational strategy emphasizes partnerships with global brands while also promoting localized solutions to meet the needs of China’s evolving supply chains.

Market Context: A Record-Breaking Year for Distributors

According to the 2024 ranking of China’s top 25 component distributors, the industry recorded an aggregate revenue of RMB 247.03 billion, a 36% year-on-year increase from 2023. This marks the first time the figure surpassed the RMB 240 billion threshold, reflecting both recovery from the 2023 downturn and strong demand for AI-related products.

- 21 of the 25 companies reported positive growth, tripling the number compared to 2023.

- Seven distributors joined the “Hundred-Billion Club,” achieving annual revenue over RMB 10 billion.

- Leading players such as SAC, TechSource, and Shannong together accounted for 43.5% of total revenue, reinforcing the trend of consolidation.

For Shenzhen Energy Source Electronics, this rising tide offers a favorable environment to scale operations. Its performance aligns with the broader narrative of domestic distributors benefiting from China’s semiconductor localization strategy, as the government pushes forward policies to reduce reliance on foreign suppliers.

Role of Shenzhen Energy Source in the Component Supply Chain

The company’s role is best understood in three dimensions:

- Distributor of Choice for SMEs – Many smaller electronics manufacturers lack the scale to negotiate directly with tier-one suppliers. Energy Source provides them with access to components at competitive prices, coupled with logistics and technical support.

- Bridge Between Global and Local – By working with both international semiconductor companies and domestic IC design firms, the distributor positions itself as a crucial bridge that aligns global technologies with local production needs.

- Support for Emerging Industries – In sectors like EVs, AI devices, and industrial IoT, Energy Source has actively promoted components including MCUs, power devices, and memory solutions. This aligns with national priorities in digitalization and green energy.

Financial Performance and Industry Position

Although Energy Source is not yet among the “Hundred-Billion Club,” it has consistently grown in double digits since 2021. Analysts estimate that its 2024 revenue exceeded RMB 5 billion, placing it firmly in the mid-tier of the Top 25 distributors.

What sets the company apart is not sheer scale but its flexibility and targeted focus. While giants like SAC rely heavily on volume-driven business across multiple sectors, Energy Source has concentrated on growth niches:

- AI hardware components

- Automotive electronics

- High-performance storage and power devices

This positioning allows the firm to capture high-margin opportunities without competing head-to-head with larger incumbents in commoditized markets.

Embracing the AI Era

The most striking trend in China’s component distribution market is the explosive growth of AI-driven demand. GPUs, HBM memory, AI servers, and data center infrastructure have become key revenue drivers.

- SAC reported a 371% increase in AI-related revenue in 2024.

- TechSource and Shannong also doubled their AI-related businesses, especially in servers and data storage.

For Energy Source, this represents both a challenge and an opportunity. While it cannot match the scale of the industry giants, the company has actively expanded its portfolio in:

- AI accelerators for data centers

- Power modules for liquid cooling systems

- Smart sensors and embedded solutions for robotics

By partnering with Chinese AI startups and system integrators, Energy Source positions itself as a specialized supplier in the AI ecosystem.

Global Expansion and “Going Out” Strategy

Like many Chinese distributors, Energy Source is also exploring opportunities abroad. Data shows that in 2024, overseas revenue for Chinese distributors grew 50% year-on-year, compared to 26% in the domestic market.

- Firms such as Shannong reported a 138.9% increase in overseas sales.

- Lierda and Yachuang doubled their international revenue through partnerships in Europe and Japan.

Energy Source has started to establish sales channels in Southeast Asia and India, regions where demand for smartphones, EVs, and consumer electronics is booming. By building overseas offices and forming partnerships with OEMs, the company aims to capture new growth while diversifying away from a solely domestic customer base.

Challenges and Risks

Despite positive momentum, Shenzhen Energy Source Electronics faces several structural challenges:

- Market Consolidation – As larger distributors dominate with economies of scale, mid-tier players risk being squeezed unless they differentiate through niche strategies.

- Policy Uncertainty – Trade disputes and tariffs remain a wildcard, potentially impacting global sourcing and cross-border logistics.

- Technology Shifts – Rapid changes in AI, EV, and semiconductor technologies require ongoing investment in technical support and inventory management.

- Margin Pressure – Fierce competition among distributors often leads to thinner profit margins, requiring careful balance between scale and profitability.

The company’s resilience will depend on its ability to focus on specialty markets, adopt digital tools, and align with China’s national semiconductor policies.

Looking Ahead: Energy Source’s Strategic Position

As 2025 begins, optimism in the component industry remains strong. The market is expected to grow further, driven by:

- AI compute demand and large model training chips.

- Expansion of AI smartphones, PCs, and robots.

- Government subsidies for consumer electronics and EVs.

For Shenzhen Energy Source Electronics, the path forward lies in balancing domestic strength with global expansion. Its role as a connector between global innovation and Chinese demand gives it a unique edge, especially in the fast-moving AI and automotive sectors.

In my view, while Energy Source may never rival SAC or TechSource in raw revenue, it has the potential to become one of the most agile and innovation-focused distributors in China. If it continues to build expertise in AI-related components and expands internationally, its long-term relevance in China’s semiconductor supply chain is assured.

Conclusion

Shenzhen Energy Source Electronics exemplifies how a mid-tier distributor can thrive in a market dominated by giants. By focusing on AI-driven opportunities, expanding into overseas markets, and leveraging its Shenzhen base, the company has established itself as a key player in China’s component distribution market.

Its trajectory reflects broader industry trends: consolidation at the top, growth fueled by AI and EVs, and increasing globalization of Chinese distributors. For global buyers, Energy Source represents a partner capable of offering both localized insights and international connectivity, making it an important name to watch in the years ahead.